Los Angeles IRS Tax Power of Attorneys

We are licensed Los Angeles tax 'power of attorney' representatives that aggressively represent taxpayers before the IRS and State.

If you’re looking for the best tax firm in LA, call Hillhurst Tax Group for a free consultation.

#1 Rated IRS Tax ‘Power of Attorney’ Representatives* in Los Angeles, CA

If you owe the IRS, our tax ‘power of attorney’ representatives can help settle your back tax debt, stop tax garnishments and levies, release tax liens, provide IRS tax audit help, and file back taxes for you.

CALL OUR TAX ‘POWER OF ATTORNEY’ REPRESENTATIVES NOW TO SCHEDULE YOUR FREE OFFICE CONSULTATION

Why Choose Our IRS Los Angeles Tax 'Power of Attorney' Representatives?

Many national and out-of-state tax resolution firms or IRS tax attorneys claim to have the competency to handle out California state and California resident IRS tax resolution cases. Unfortunately, not every firm is fully capable of following through on their promises with out-of-state clients. The California Tax Code alone has over 60,000 rules. Finding an IRS Tax ‘Power of Attorney’ Representative in your local area provides you with significantly better service and reduces the amount of time needed to resolve your tax problems.

By hiring local, you have the opportunity to visit your Los Angeles IRS tax ‘power of attorney’ representative in a face-to-face meeting. This gives you a chance to visit their office, check their credentials, and remain in contact without the additional hardship that is often caused by phone calls and mail. Our income tax power of attorney representatives possess the highest degree of knowledge relating to the tax code. It is critical that your case is handled appropriately for a timely and painless tax resolution process. By hiring a local tax resolution firm, you will bypass communication hiccups and clear your IRS debt much faster.

Without the best representation, settling your tax debt can entail a long and complicated process, resulting in unnecessary stress, possible financial hardship and further tax implications.

Serving Los Angeles, Orange, Riverside, San Bernardino, San Diego, & Ventura County

STAFF OF TAX ‘POWER OF ATTORNEY’ REPRESENTATIVES WITH MILLIONS OF TAXPAYER DOLLARS SAVED SINCE 2012

100% Privacy Guaranteed.

We do not share your information with any third party

Call 323-486-3314 for a free consultation or fill out the form below

Experienced IRS Tax ‘Power of Attorney’ Representatives

in Los Angeles

Read Our 5-Star Reviews

What is an IRS Tax ‘Power of Attorney’ Representative?

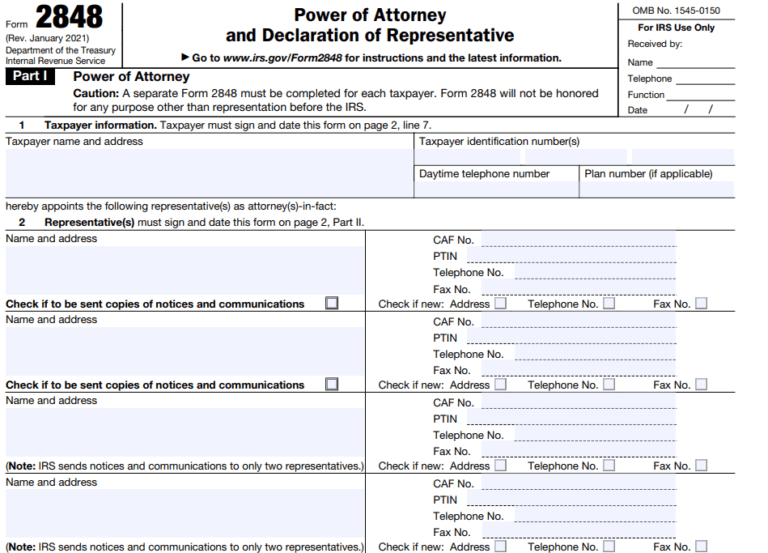

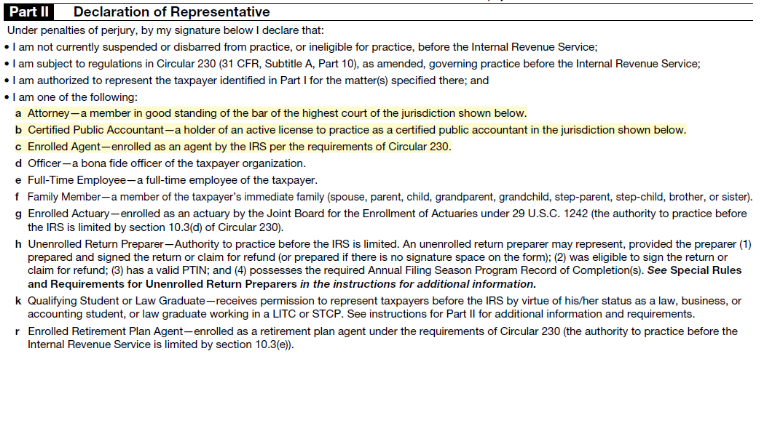

The IRS Tax Power of Attorney, Form 2848, is used to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS. You can choose an Attorney, CPA, or Enrolled agent as the eligible person authorized to represent you.

Our Tax Relief Services

➕ Currently Not Collectible

➕ Payment Plans/ Installment Agreements

➕ Tax Lien Discharge

➕ Tax Lien Subordination

➕ Tax Lien Release

➕ Bank Account Levy

➕ Filing Back Taxes

➕ Bookkeeping Services

➕ State of CA FTB

➕ State of CA BOE

➕ State of CA EDD

➕ Settling Tax Debt

➕ Foreign Bank Account Reports

➕ Innocent Spouse Relief

➕ Collection Due Process Hearing

➕ Tax Audit Representation

➕ Tax Return Preparation

➕ Bankruptcy For Taxes

➕ Nationwide Tax Relief

➕ El IRS en Espanol

Our 4 Step Tax Resolution Process

STEP 1 – FREE OFFICE CONSULTATION

STEP 3 – PREPARE FORMS & RESOLUTION

STEP 2 – IRS & STATE INVESTIGATION

STEP 4 – SUBMIT & GET RESULT

What Our Clients Are Saying

Honest & Actually Helpful

I wanted to know if I qualified for an Offer In Compromise on my IRS tax bill, so I contacted three large firms that advertise their ability to get an IRS settlement. All three wanted $1000 down before they would review my case. If I did qualify, they wanted a percentage of my debt reduction. And if I did not qualify for an Offer in Compromise, they said they could get me a payment plan from the IRS — but I was able to do that myself.

When I contacted Hillhurst Tax Group, the first thing Jonathan told me was that he would not charge me upfront. Instead he reviewed all my income and expenses and ran my numbers through the IRS formulas and guidelines and told me that the IRS would not accept my Offer due to my income/expense ratio and their allowable amounts. Instead, he outlined a short-term and long-term strategy I could pursue to resolve my tax bill in a way that would be accepted by the IRS.

What kind of price can you put on integrity and sound advice? Jonathan demonstrated a complete grasp of the Offer In Compromise process and explained to me the parameters and scenarios in which I would qualify for an accepted offer. Instead of being out $1000’s, I am now on my way to resolving my IRS debt.

Mike S.

Got rid of my penalties

After finding out I owed a penalty amount on my 2013 corporate taxes I decided to get help. I called around to a lot of the bigger tax relief firms but ended up getting passed around from one person to another and placed on hold. I felt they would not be able to dedicate their whole time into my case since they are so swamped. I came to hillhurst tax after researching local tax resolution firms. After speaking to Jonathan he gave me the assurance I needed. Before he even talked about fees he genuinely wanted to make sure my case could be helped. He contacted the irs and reviewed my finances all for no charge. After he accepted my case he went ahead and submitted the irs form. I only got charged after all these services were done. The result was Hillhurst tax group was able to eliminate all my penalties and interest for a very affordable rate. I highly recommend this firm if you’re having issues with IRS. You don’t have to worry about being charged upfront and you can expect a face to face consultation.

Alex V.

Tax Returns

Reallly good help this people will go out of their way to help you and last year i didt do my taxes with them but this up coming year im sure ill be the firts in line check them out they really honest and nice people the will really help you

Jorge G.

Great customer service

Jonathan really cares and I now feel a lot better with him on my side. Hillhurst tax group will continue to work and resolve my IRS problem in 2016, I highly recommend the hillhurst tax group, no need to go anywhere else.

Keith

Jonathan McCormick Tax Consultant

I thank all of the tax group staff. Jonathan McCormick was very professional and always willing to answer all my questions, they did an awesome job. I was at a loss not knowing where to turn to.The initial contact was good and I knew then that I was doing the right thing. Jonathan McCormick , was assigned to my case, and he was fantastic on getting it all resolved professionally and timely. I commend you people so much for helping me and so many people like myself, when we don’t know where or who to turn to. Thank you Jonathan McCormick, for all the work and time you took with my case, I will not hesitate to refer any one. Fantastic Job!!!

Mae V.

TOP NOTCH

Very satisfied!!!…excellent representation…I would highly recommend Mr. Jonathan McCormick. From the very beginning we had help and expert advice on my tax situation and a step by step explanation. The entire process took nine months,(as it can take time for the IRS to respond) but it was well worth it. I started working with Josh and he was very courteous, kind and attentive as I explained the circumstances of my tax liability. He really made me feel at ease and I felt confident I was going to get the help I needed. The paperwork involved went pretty smoothly. I can’t thank Jonathan McCormick and his team enough for being able to deliver on what they promised, and with such integrity and professionalism. I owed the IRS over $12,000 and was able to negotiate a compromised settlement of just $100.00 last month. Thanks again!!

Robert L.

Hillhurst Tax Group

Jonathan McCormick was very helpful and we are a very satisfied customer. My situation with the IRS was difficult and stressful; however, we were able to come to a satisfactory solution. We are thankful for their service and would highly recommend them to anyone who has similar issues to resolve. Thank you again and we are looking forward to continuing their services.

Leslie T.

Audit Representation was wonderful!

I hired for help with my IRS tax situation. I had been audited by the IRS for 2010 and 2011 tax years. According to the IRS I owed over $28,000. My Case manager Jonathan McCormick did a fantastic job with an Audit Representation, upon completion of my case I only owed $6,635. I saved over $22,000! I am so pleased to be free from the entire financial burden this caused.

John S.

Life after debt

I don’t know what I would have done without your help. Jonathan McCormick spent a great deal of time with my case. I had lost my house to a short sale, filed bankruptcy and still owed money to the IRS. My CPA was not willing to spend the time to file a settlement. This economy has hit many of us very hard. It was difficult to make ends meet and to add tax debt to the picture! I was introduced to Jonathan, I received a settlement for $100!!! Thank you. There is finally life at the end of the tunnel. Brenda

Brenda M.

About Our Tax ‘Power of Attorney’ Representative

If you are searching for a Los Angeles Tax ‘Power of Attorney’ Representative then you’ve come to the right spot. Hillhurst Tax Group is a tax relief firm, meaning we aggressively represent taxpayers before the IRS and State. We specialize in all related IRS and State tax issues.

If you owe IRS back taxes and want to settle your debt, need IRS tax audit help and representation, file late back taxes, innocent spouse relief, offer in compromises, need to stop an IRS wage garnishment, IRS & FTB tax levies, IRS bank levy & tax lien release, or simply need an investigation with the IRS to see what can be done, then we are here to help.

Our licensed team of Local Tax ‘Power of Attorney’ Representatives have a combined 30 years of tax resolution experience dealing with the IRS and the State. We deal with the IRS, Franchise Tax Board, Board of Equalization, and Employment Development Department taxing agencies.

Our mission and goal is to allow our local clientele the ability to come into our office for a free consultation and meet a licensee to see what their options are. With so many nationwide firms out there, our clients prefer to come to the office with their documents in person.

Success Rate

Our average settlement on an Offer In Compromise is 5 percent of the client’s total tax debt. Our firm has a 94 percent success rate on an offer and compromise (learn more at our offer in compromise case study.) We pre-screen all potential candidates vigorously before we accept a case.

Our staff has a working relationship with many local IRS agents and officers, making it easier to negotiate a better and more favorable audit outcome for you.

We are available to our local Los Feliz community and surrounding cities in Los Angeles county such as Glendale, Burbank, Pasadena, Beverly Hills, Hollywood, Long Beach, Palmdale, Torrance, Lancaster, Downey, and Orange County, Riverside County, and San Diego County, as well as all of Southern California.

Hillhurst Tax Group’s tax relief services are affordable for all income ranges, so fees should be the least of your worries. We are mostly interested in making sure that we meet your expectations and can deliver a successful solution to your tax problem. When you email or call us we will get back to you the same day. Call us today at 323-486-3314 to hear how we can help you!

Why Hire A Los Angeles IRS Tax 'Power Of Attorney' Representative?

Tax problems cause sleepless nights for millions of Americans and delaying the problem will only make the situation worse. Most people who face IRS tax problems turn to a tax power of attorney representative for help. Below are the most common reasons for hiring an IRS tax power of attorney to obtain the proper tax relief results.

The tax law is complicated. It runs about 70,000 pages. Every taxpayer has a unique case where they may need to know and understand the tax code to prevent abusive and illegal practices done by IRS revenue agents and officers. The only qualified individuals to deal with this are IRS Tax ‘Power of attorney’ representative preferably those who also are either tax certified specialists by their state or have a masters in tax law degree LLM. In certain cases, the IRS makes mistakes on a taxpayer’s liability and having a licensed tax attorney that knows the code will drastically increase the likelihood of a taxpayer reducing his tax debt.

Time is money. As a hard working wage earner or self-employed business owner, it’s very time consuming dealing with the IRS and working a full time job. Many clients have stated that they are mentally drained trying to solve their tax issues and this affects their work causing them to under-perform and neglect their business. Hiring a tax ‘power of attorney’ representative will allow you to focus your energy on your personal life. You will sleep better knowing the issue is being solved by a professional. As a client, it’s best to get weekly updates and invoices from your attorney. This will give you the assurance you need that the work is being done.

An IRS Tax ‘power of attorney’ representative can help you negotiate a settlement with the IRS. Most people do not know that there are three different types of offer in compromises in place. They are doubt as to collectability, doubt as to liability, and effective tax administration. Most taxpayers don’t submit the proper offer causing a rejection and are now stuck paying the IRS back the full debt amount with interest and penalties. A knowledgeable tax attorney can help you determine which one you should submit for optimal results. For more information on the offer in compromise click here.

The first step in effectively solving an IRS debt is taking action immediately. Not only does this show good faith, but also it increases your chances of lowering a tax liability while your records are still fresh. The best example is getting an audit letter from the IRS claiming you owe money. An IRS tax ‘power of attorney’ representative can effectively represent you in a tax audit to make sure that the assessment made by the revenue agent is not more than what you need to pay. Most taxpayers make this mistake of going to an audit by themselves and end up leaving with a hefty bill. The worst thing you can do is to represent yourself. This can cause the IRS to obtain more information from you than you are required to give by law and expand the audit process to multiple years, which you never expected. Stopping the fire before it gets bigger is what effective audit presentation will provide. Do not go to the audit alone and see what the agent says. Get the proper representation and leave with a low assessment. Re opening up an audit is difficult and you may lose your chance the first time around.

The ability to negotiate the lowest possible settlement is a skill. Tax ‘power of attorney’ representatives are trained to prevent you from paying more than you need to. A common example that we see is clients offering much more to the IRS to settle their debt through an offer in compromise. Just recently we had a client submit an $18,000 for a $100,000 debt. We withdrew the offer and resubmitted with a $500 offer. The client’s offer was accept and he saved $18000 that he would have otherwise paid. The client’s testimonial is provided in this link. Sometimes during an audit you have to negotiate your deductions because the tax law is nor black or white. There are grey areas. Negotiations also come in handy when an IRS tax ‘power of attorney’ representative is talking to opposing counsel from the IRS or when he is appealing an unfavorable IRS decision.

IRS tax ‘power of attorney’ representatives are excellent writers. When you owe the IRS heavy penalties and are trying to remove them, the IRS would like to see reasonable cause. This means that you exercised ordinary business care and out of your control you could not stop the penalties from accruing. Showing reasonable cause requires research time and a proper letter that will convey to the IRS why you deserve to have your penalties abated. An IRS tax ‘power of attorney’ representative can provide this.

Some, but not all IRS tax attorneys have excellent rapport with local IRS agents. Here at Hillhurst Tax Group our tax ‘power of attorney’ representatives know the IRS agents who audit small businesses. They know how we work and what we are looking for. This creates a business relationship that allows us to negotiate the best possible tax settlement and audit outcome for clients.

Dealing with collections is a specific niche practice. There are many tax attorneys who can help you with tax preparation or tax planning, however trying to stop collection activities is a whole different skill set. An IRS tax ‘power of attorney’ representative can stop a garnishment, levy, and even release a tax lien. They know how to present a hardship to the IRS and paint a picture that shows you cannot afford your current monthly installment agreement. Common example of releasing a lien is when a business owners’ income is affected by the lien. An IRS tax ‘power of attorney’ representative can help prove a hardship.

Our Los Angeles Tax Relief Office

OFFICE LOCATIONS

2150 Hillhurst Ave, Los Angeles, CA 90027

Phone: (323) 486-3314

info@hillhursttaxgroup.com

330 Arden Ave #110, Glendale, CA 91203

Phone: (818) 446-1808

info@hillhursttaxgroup.com

DISCLAIMER: We are not a tax law firm. We do not perform any legal services. We provide only tax relief representation services per IRS Circular 230.